This substack now has 60 subscribers, including both familiar names and some complete strangers - whom I can only assume have clicked through by accident. On the basis of a typical paid : free subscriber ratio of 2-3%, that means that at least one of you would pay to receive my ramblings.

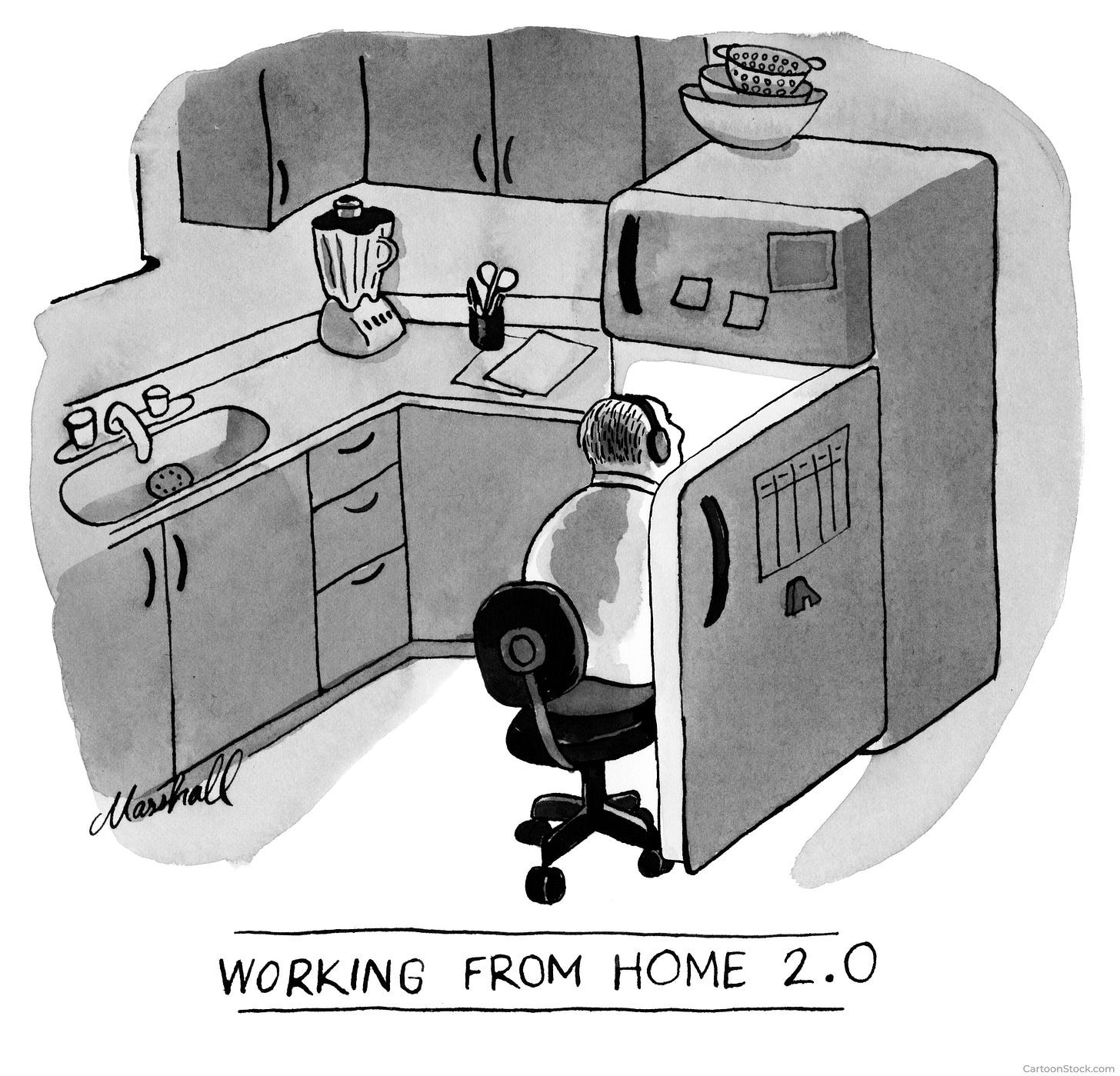

I’m still wfh but will have some more news very shortly. In the meantime, I miss office air-con…

Markets

The big news in the markets today (and the reason why I should have sent this out on Friday!) is the US strike against Iran over the weekend and potential disruption in the Straits of Hormuz. For now, credit markets remain strong with issuers keen to lock down funding before it develops further and investors willing to get involved, for a little extra spread.

The Fed and Bank of England each declined to follow the ECB in cutting rates in response to slowing economic conditions, even though inflation remains high. Oil prices have spiked by over 20% since the start of June (even though they fell today); combine this with new tariffs due in 19 days and we might see a repeat of the 1970s: high inflation driven by supply-side shocks, which cannot be solved by higher rates without decimating the economy.

1. Putting the AI in Credait

I had some interesting discussions last week with a major rating agency and global investor about how AI might change credit investing. My experience in the client-facing parts of investment banking is that management is wary about sharing private / confidential information to external AI providers - or even allowing the information to be shared internally, beyond those who have a ‘need to know’.

At the moment, all I’ve seen is the introduction of AI ‘research assistants’ on ratings agency sites, on the basis that all this information is public. But I think AI will be used much more than this. I’ve put some ideas below and would welcome any feedback on other uses:

Preparation of credit papers: this should be pretty easy for AI, particularly if relying only on public information. I’m a bit conflicted here: I like to be believe that the act of researching and writing actually brings greater insights on the part of the person doing all the work. Do you really ‘know’ a subject or issuer if you’re relying in large part on what an AI bot has produced? But against this, my kids don’t enjoy writing as much as me and they swear by AI to produce a ‘first draft’ for their work (A-level results in 6 weeks should validate this approach, or not …")

Application of ratings methodologies: by design and regulation, credit rating agencies have highly-structured and transparent criteria. Moody’s ratings grids and scorecards are a good example. These should be perfect for AI: an indicative credit score can be established according to a defined function of public data. Of course, an actual rating is not determined this way: there are modifiers and adjustments due to relative positioning vs peers, and the final step is a ‘ratings committee’ where real people come to a judgement. But still …

New insights into credit scoring: perhaps we will just set AI off to “calculate the probability of default of [X] plc according to all public information”. Maybe it will base some of this on innovative data sources e.g. comments made on social media by key management, NLP analysis of investor calls, the thickness of the annual report, the design of their website, reach of their web advertising - who knows what else?

Summarising DD: quite often in private / leveraged credit, the various diligence reports can easily exceed 1,000 pages. I’m going on a limb to say that most investors generally only read the exec summaries, with the rest being available for a deep-dive on a particular topic. AI could help here, picking out the most interesting insights. (Though surely it would be better if DD providers actually spelt out only the most important points, instead of the most common CYA approach)

I hope the key benefit will be to redirect time previously spent on mundane work (comparable ratio analysis) towards more insightful judgements. But the popularity of this video of the Cat Olympics suggests people want a different sort of ‘deep dive’.

Let me know your best AI life hack.

2. “No Mr Sterling Bond market, I expect you to die”

Bloomberg wrote last week about the decline in the sterling bond market, noting that Sterling bonds are only 4% of global indices (down from 8% in 2009). This fear has been circulating since the start of the Euro, since the Global Financial Crisis and since Brexit.

Yet the data suggests otherwise: the chart below shows the mix of GBP, EUR and USD bonds issued each year with Sterling consistently around 4-5% (underlying data from Bloomberg league tables).

Bloomberg cited EUR bonds from Gatwick, Manchester Airport and London Power Networks, but could have also mentioned EUR bonds from global businesses such as Informa and Compass.

Asda is a good example of an entirely-UK business using EUR markets: it recently issued €700m 6-yr bond at 8%, which in Sterling equates to c. 10.5% (or S+650bp). This is broadly similar to its GBP pricing (2030 yields 9.8%) but suggests that its GBP investors were a little full - or that Asda wanted to diversify its funding sources.

The EUR market is deep, relatively liquid and enables quick access (with an EMTN) but issuer with GBP funding requirements must swap bond proceeds back to Sterling, via by its banks. Swaps are great fun but they add complexity to documentation and accounting and can be costly (0.10-0.40% p.a. depending on credit profile). Moreover, any early redemption of the bond will require early breakage of the swap, which may require an additional cash payout depending on relative interest rate and FX markets.

3. Liability management vs Liability Management Exercises

In investment banking, there are typically two quite different approaches to he benign-sounding phrase ‘liability management’:

More old-fashioned: early redemption or tender for existing debt (or an amendment) by a healthy issuer, often alongside a new deal. This ‘liability management’ is usually carried on by the DCM desk of a bookrunning bank and it’s (nearly!) always consensual, with investors being offered a small premium to participate

More American: an offer by a more stressed borrowers to (some?) existing lenders to offer some flexibility to the borrower (an extension, waiver, additional debt or PIK interest), in return for (i) some fees and / or (ii) the agreement that the borrower will not screw the lenders in some imaginative way.

#2 is typically known as a “Liability Management Exercise” and is becoming increasingly common in the US, particularly in high yield bonds and leveraged loans. Bloomberg reports that “Liability Management Exercise” featured in news articles 30 times in Q2 2015 compared to 285 times in Q1 2025.

The practice of threatening creditors has also spread to Europe (e.g. Altice) and to private credit (e.g. PluralSights).

The key to all of this is weak documentation: what was badged as “senior secured debt” turns out not to be senior, secured or even debt - more like a non-voting class of equity, where the dividend is optional. Borrowers have made use of intended and unintended loopholes to move collateral out of reach of creditors (drop-downs) or insert new layers of more senior debt (up-tiering). In many cases, lenders knew about the potential leakage but assumed that management wouldn’t use the flexibility, or that they could trade out of the debt before this happens.

So far at least in Europe, LME has mainly being used by one-offer issuers like founder-led businesses like Altice and Ardagh. But it won’t be long before LME becomes more mainstream for private equity businesses - one compelling argument is that while there may be reputational damage to the PE owner going forward, this shouldn’t offset its fiduciary duty to the Limited Partners in that particular investment to make use of all available tools to preserve value.

Selected UKish deals last week

IG Bonds

Asda (B1 / B+ / BB) €700m 6-year non-call 2 at 8%, tightened from 8.5% at launch. Equates to 10-10.5% in GBP

Compass (A2 / A) €700m 7Y at mid-swaps+87p (in from 120bp area)

Gatwick Funding (Baa1 / BBB+ / BBB+) €750m 10Y sustainability linked bond at ms+138bp (in from 175-180bp at launch). Coupon steps by 12.5bp if SBT1 not met, +50bp is SPT2 not met)

HY and leveraged loans

Eir (B1/ B+ / B+) €300m loan to refi a 2026 bond, priced at E+275bp and 99.5, a little tighter on OID than launch. It also completed a €100m privately-placed tap of other notes

TDR’s Agrekko launched an Amend & Extend of EUR and USD 2029 debt, talked at E / S + 300bp, pricing this week

Arqiva is out with HY bond to refinance debt - more on that next week

Not UK, but Italy’s Fibercop (Ba1 / BB+ / BB+) priced €2.8bn of HY bonds at around 5%. The deal size was doubled in market which is definitely evidence that the market backs Fibercop’s plans to invest in Italian broadband. More here

Ares has emerged as lender to MPE in its buyout of Renold: $325m for 6-years plus a $25m RCF, at SOFR+625bp dropping to 575bp when leverage falls below 3x

Corporate loans

Funding Circle renewed a £230m facility with Citi to fund build-out of new products

Co-op retailing has arranged a new £350m 5-year term loan, alongside its £400m RCF, to pre-fund the repayment of some legacy bonds

Other

It looks like PHP will be successful in fending off KRR to acquire Assura, with its latest improved offer being recommended by Assura’s board

KKR may miss another take-private with the board of Spectris opting for Advent instead. KKR says it is in the process of arranging financing but Advent already has commitments from MS, Barclays and HSBC